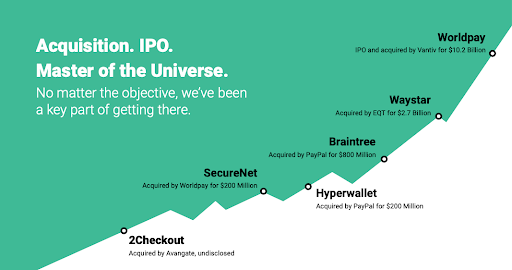

We work with growth-stage to enterprise fintech marketers who all have one thing in common: They want to pour rocket fuel on their performance marketing programs. Whether their end goal is to become acquired, IPO, or become masters of their own universe.

A large part of Envisionit’s success over the years is due to the fact that we got an early start helping emerging fintechs chart their course. With Braintree, we were one of the earliest fintech marketing agencies to take a company from Series A all the way through a sizable acquisition with PayPal. Over a decade later, we’re happy to say we’ve played a key role in helping so many companies realize the same success. We’ve also helped marketers in their quest to simplify their worlds and evolve professionally in their own roles through the support we bring.

Charting your course

You may be thinking, “Not every fintech wants to be acquired.” You’re right. So why are we calling this out? In our experience, fintechs are not acquired due to the strength of their solution alone. There’s still a journey to getting there. No matter what your end goal is (and even if you haven’t figured it out yet), our approach considers the parts and the whole of your organization’s growth plan, and we develop go-to-market strategies that are built to scale and can pivot quickly (and frequently). Most importantly, we maintain full alignment with key stakeholders as we evaluate performance against what we know needs to be true today, and how we should be thinking about the future.

Do you need to show exponential growth in monthly active users (yesterday)? Are you focused on gross transaction volume, annual recurring revenue or return on ad spend? Are there new features you’re rolling out to brand new audiences or existing customers and you need a partner to show how this has been accomplished successfully with other companies who were in the same boat? These are just a few of the challenges we’ve successfully managed over the years.

We’re often asked what the secret is. It really comes down to 3 things.

1. We get fintech. Our success with Braintree and Venmo was undoubtedly a boost to our street cred, but to keep our momentum going, we had to continue to deliver. From 2Checkout, Securenet and Worldpay, to Hyperwallet, Pangea, SeedInvest, and more. Beyond writing the fintech marketing playbook (literally, and we’re working on a second edition), we’ve maintained our edge in the space by:

- Hiring adrenaline junkies who thrive on figuring out how to navigate change in a category that experiences constant disruption.

- We have an advisory board with a range of experts from attorneys to crypto experiential connections to PR firms to fintech business leaders and more at our fingertips when we need them.

- We immerse ourselves in sales. We take insights from the sales process and embed those into our strategies to make our marketing dollars work harder.

- We fail forward. A big part of this has been how we’ve adapted to working across a company’s marketing and sales teams to drive measurably better outcomes. This has often meant that we’ve taken our engagement far beyond what was originally intended by demonstrating to our clients that we’re more focused on achieving our outcomes and earning the role of trusted advisor than simply earning a paycheck. Beyond generating demand, we want to understand the end-to-end of our marketing programs. In this sense, we grade our own work and not only fine-tune our own messaging and targeting, but partner with sales to determine how we can enable them long after the lead is generated.

- We buddy up with product teams to understand what’s coming down the hopper and use our keen understanding of the audience to guide product strategy and plan marketing.

2. We operate with a lean-forward mindset, so our clients don’t miss opportunities. Being proactive isn’t a novel idea in itself, but it can’t be underestimated when it comes to fintech marketing. By virtue of taking the measures noted above to ensure we “get fintech,” we’re positioning ourselves to be one step ahead for our clients.

Need some examples?

- We recommended a product innovation for one of our clients that would revolutionize the liquidity of alternative assets for their target audience.

- We identified whitespace opportunities with a target audience that completely changed the course of marketing and messaging, and ultimately, how we measured performance. We were actually able to accelerate their acquisition by delivering merchant sign ups by way of key influencers within target organizations.

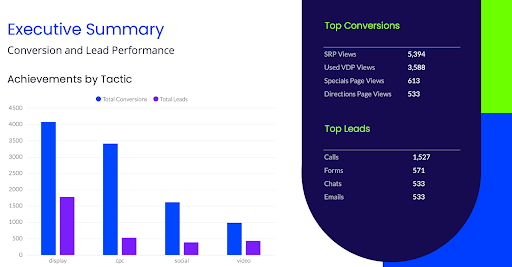

- We proactively reviewed our client’s data structure and developed a re-engineering strategy that not only provided the granular insights we needed on the day-to-day, but the bigger picture performance analysis needed for executive leadership share-through. It was very well received.

- We isolated where our target audiences are not consuming information to dial back media spend (even when we were the ones running paid media). If we can get to our goal more quick and efficiently, we’re not going to hold back a recommendation when we know its in the best interest of the overall program.

Is every opportunity we bring to the table acted on? Not always, but often. At bare minimum, our clients know they can rely on us and we have their backs.

3. We make decision making easy. When it comes to understanding what we’re going to do, why we should do it and how it’s going to be accomplished; the plan should be clear, simple to understand and actionable for our clients. This means we can work faster and grow faster.

Whether you’re at the beginning of your growth journey or need a catalyst for your next major milestone — Envisionit’s depth of experience in the space continues to help fintech organizations fast-track their path.

Interested in learning more about how our approach to fintech marketing can apply to your fintech? Let’s connect.