Here’s what you need to know about proactive and reactive performance marketing assessments

Tech companies move fast. We’d argue fintech moves even faster. So, it’s easy to get overly prescriptive (and perhaps a bit overconfident) in the name of speed. We aren’t suggesting you slow down. Instead, we’re sharing insights you may not have considered when it comes to prioritizing and delegating your efforts, allowing you to zero-in on the key metrics.

Here’s what we’re covering:

- Strategic communication when evaluating fintech performance marketing

- Connecting specific campaign goals to overall marketing objectives

- What to include in every campaign pro forma

- Bottom-funnel efficiency vs “last click” performance in channel evaluation

- Optimal data visualization and reporting practices

Proper communication when evaluating fintech performance marketing

We’ve all done it. We launch. We hover. We ask, “how’s it going?” at 5 a.m. the day after a launch. Marketing is full of overachieving professionals that wake up every day thinking about what’s next and how they’re going to beat the world. And when it comes to your organization’s investment in performance marketing, you’re right to be diligent stewards of those dollars.

You should expect your internal media team or fintech marketing agency to proactively communicate campaign performance. If you’ve got the right team members in place, they’re going to tell you when you should reach the point of concern if they have enough data to assess and prescribe with confidence.

Before you get started, ensure the following are in place:

Connecting specific campaign goals to your overall marketing objectives

- Determine if the goal is demand generation or lead generation.

- Once determined, assess that channel or platform’s historical performance against similar industry goals.

- Your campaign goals, the size of your audience, and the channel’s purpose will factor into exactly when you assess performance and how you’ll optimize toward your goals.

What to include in every campaign pro forma

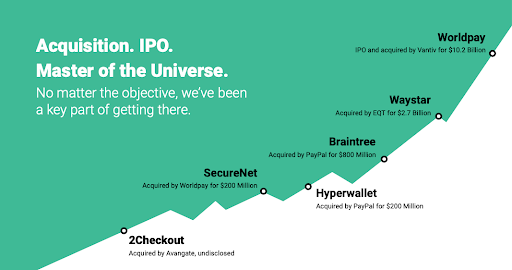

You might be thinking, “We have no historical benchmarks.” And that’s OK. If you choose the right fintech marketing agency to partner with, their collective experience with other fintech clients will give you benchmarks that are rooted in data from similar campaigns and clients.

If you don’t have that luxury, you’ll need to rely on the channel- and industry-level data available that will allow you to develop hypotheses that can be applied to a pro forma. This includes all channels and primary and secondary delivery metrics used to assess performance, including but limited to:

- Impressions

- Click through rate (CTR)

- Cost per thousand (CPM)

- Cost per acquisition (CPA)

- MQL to SQL ratio

- Customer acquisition cost (CAC)

- Transaction volume

- Assets under management

Get it “on paper” and regularly assess your pacing based on your monthly projections.

Bottom-funnel efficiency vs. last click performance in channel evaluation

It takes anywhere from 7 to 13 touchpoints for a fintech prospect to take action. That means the channel you’re evaluating that may bring undesired results may actually be your saving grace. Establish proper tracking upfront so that you’re not simply reliant on the platform data itself, which will never reflect your backend data.

For example, Facebook has up to a seven-day attribution window. You can set other attribution windows manually for other platforms. DSPs often have their own “proprietary” view of attribution to consider. Isolate your source of truth, like Google Analytics, and set up tracking accordingly.

Avoid prioritizing the “rearview mirror” approach to evaluating campaign performance

If you’re not careful, asking your team or agency partner to “look back,” could inadvertently create analysis paralysis.

Here’s a scenario:

- You ask your fintech marketing agency or internal team member to pull a historical report for you without any context at all.

- They may focus on explaining the past to you and, potentially, over-explain the data when you need simple validation on something.

- As a result, they get distracted when they could be identifying what would drive higher lead volumes, a better ROAS, or a lower CPA.

We’re not saying a look in the rearview is not important, but be clear on why you’re asking for the data to avoid wasting time and energy.

Fintech performance marketing data

When it comes to performance evaluation, focus on the right data for the right stakeholders, and leverage data visualization and automation.

Decision-making can be easier with the right martech, whether it’s your own or a partner’s. Data is the lifeblood of performance insights. Bad data means bad choices. So, what’s the secret to being thoughtfully fast when it comes to decisioning? We have two tips to help you:

1. Develop automated reporting with just the right amount of information

Other stakeholders need access to performance reporting and may not always have the benefit of sitting in on your recurring meetings to go through the data live. So, sometimes a reporting dashboard or deck is the answer.

To ensure what you deliver doesn’t take focus away from your path forward, work with the data science team to customize your performance dashboards based on what you need. Leverage reporting platforms to automate reporting so it’s easy to pull what’s needed for scheduled reporting meetings with your executive leadership team, or facilitate on-demand reporting.

This way, everyone gets what they need and your team members aren’t wasting valuable time repurposing old reports every time there is a request. A win-win for everyone.

2. Make weekly performance reporting more real-time and collaborative

This doesn’t mean that your team comes to meetings unprepared and simply “wings it.” On the contrary, if you have the right data visualization and automation in place, your team is well prepared and can come to the table with actionable insights.

There’s nothing worse than coming to pulsing meetings and getting a “weather report” that you could’ve easily gotten for yourself by looking at the data. With real-time visualization and the right expectation setting, you can make your weekly pulsing meetings interactive and collaborative.

Pick out the metrics you’ll be evaluating by channel weekly, drill into them and ask the tough questions because everyone should know what you’re going to zero-in on in advance.

Most importantly, make sure the right players are there to get the most out of everyone’s time and ensure everyone is connected not only to what they’re seeing but why they’re seeing it. This includes the right mix of strategy, media, creative, and data analysts.